|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Discovering the Lowest Mortgage Rates in Colorado: A Comprehensive GuideWhen it comes to buying a home in Colorado, finding the lowest mortgage rates is essential. Understanding the various factors that influence these rates can save you thousands of dollars over the life of your loan. This guide will help you navigate the complex world of mortgage rates in Colorado. Understanding Mortgage RatesMortgage rates are influenced by a variety of factors, including economic conditions, your credit score, and the type of loan you choose. In Colorado, rates can vary significantly depending on these elements. Factors Influencing Rates

Types of Mortgage LoansChoosing the right mortgage loan is crucial to securing the lowest rates. Common options in Colorado include fixed-rate, adjustable-rate, and government-backed loans. Fixed-Rate MortgagesThese loans offer stability with a consistent interest rate over the life of the loan, making them a popular choice for those looking to take out a mortgage in Colorado. Government-Backed LoansPrograms like FHA loans can provide lower rates and are worth exploring. To understand the requirements, visit fha approval guidelines. Tips for Securing the Best Rates

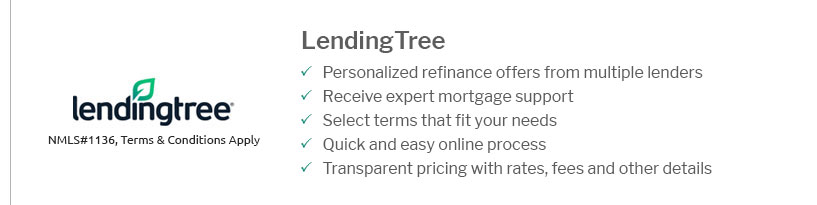

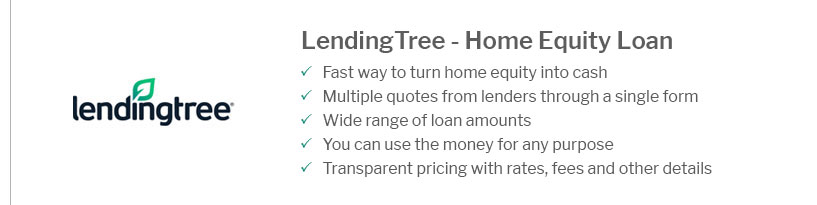

Securing the best mortgage rate requires effort and understanding. By taking the time to research and prepare, you can achieve significant savings. FAQs about Mortgage Rates in ColoradoWhat is the current average mortgage rate in Colorado?As of the latest data, the average mortgage rate in Colorado varies between 3.5% to 4.5%, depending on various factors like credit score and loan type. How can I lower my mortgage rate?Improving your credit score, shopping for different lenders, and considering paying points are effective strategies to lower your mortgage rate. Are fixed-rate mortgages better than adjustable-rate ones?It depends on your financial situation. Fixed-rate mortgages offer stability, while adjustable-rate mortgages may start with lower initial rates but can fluctuate over time. https://www.lendingtree.com/home/mortgage/rates/colorado/

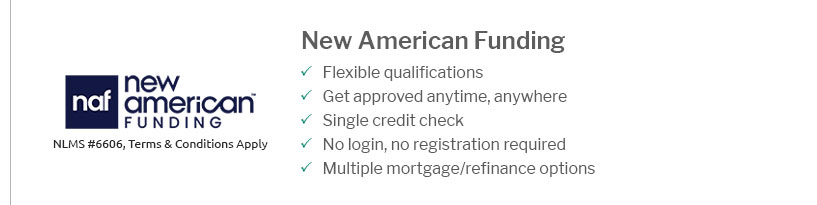

New American Funding, 5.88% - 6.63% - 6.10% - 6.64% ; Mutual of Omaha - St. Louis 2, 6.13% - 6.88% - 6.31% - 6.88% ; Cardinal Financial Company, LP - Charlotte ... https://www.totalmortgage.com/locations/state/CO/mortgage-rates

The mortgage rates in Colorado are as low as 5.875% for a 30-year fixed mortgage. These rates are effective as of March 24 2025 12:30pm EST. https://www.ccu.org/borrow/mortgage-loans

30-year Fixed Mortgage rate as low as 6.514% APR*. For more information call 720.981.2399. Swipe for More ...

|

|---|